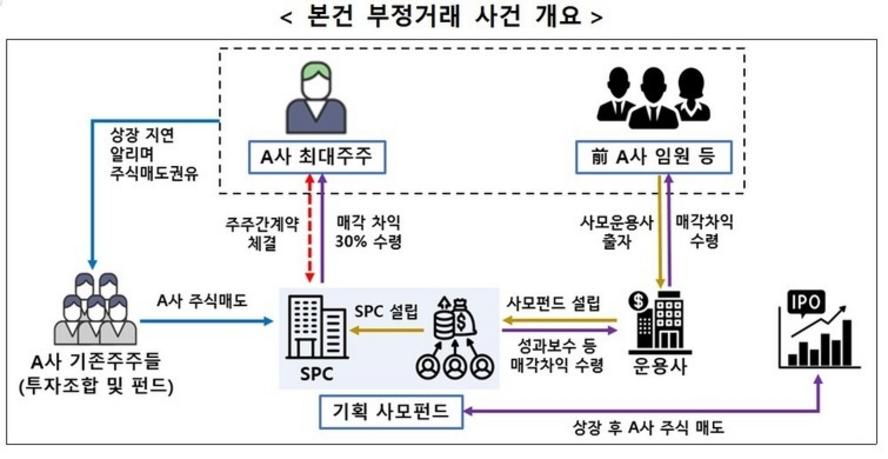

The Financial Services Commission’s Securities and Futures Commission (SFC) recently accused Hybe chairman Bang Si-hyuk of violating capital market laws by engaging in unfair trading practices during Hybe’s IPO process. The SFC claims that Bang misled existing shareholders and the capital market, gaining approximately 400 billion KRW (around $400 million USD) in undue benefits. However, this judgment is met with criticism from capital market specialists who find it difficult to identify illegal elements in the transactions and allege that exculpatory facts presented by Bang have been disregarded. The controversy ahead is expected to take over two years for judicial resolution if it reaches the Supreme Court.

Contrary to the SFC’s depiction of Bang’s trading partner as a ‘personal acquaintance,’ the individual in question is Kim Jung-dong, former Chief Investment Officer (CIO) of Hybe, credited as the discoverer and early supporter of BTS. Kim was integral to transforming Hybe from a modest agency into a global powerhouse. Formerly with SV Investment, Kim utilized his expertise in cultural content investments to lead the initial external funding round of 3 billion KRW into Hybe (then Big Hit Entertainment) in 2011, recognizing BTS’s potential before their debut. His vision also influenced Hybe’s multi-label strategy, including acquisitions of Pledis Entertainment and Source Music, underpinning the company’s diversified expansion.

The road to BTS’s global success was far from smooth. Early investments were submerged due to setbacks like the scandal-ridden disbandment of girl group GLAM, which drained crucial funds. Bang’s distinctive approach—requesting additional investments from SV Investment despite the losses—marked his commitment and earned investor trust. Kim’s role as external board member and later major shareholder advisor emphasized his ongoing influence on Hybe’s strategic IP investments and growth. Yet, during the alleged unfair trade incidents, Kim did not hold an official position at Hybe but operated externally as a capital investor through private equity fund EastonePE.

EastonePE, led by a Kim acquaintance, acquired key shares from old investors, helping to scale Hybe’s valuation. Even as these deals stirred suspicions of conflicts of interest, Kim’s careful adherence to fiduciary protocols and his return to Hybe as CIO in 2020 reinforced his central role in globalizing the company further. His leadership drove Hybe’s multi-label system, notably integrating Pledis Entertainment—home to popular boy group SEVENTEEN—and Source Music, the agency behind girl group Le Sserafim, strengthening Hybe’s market dominance.

Industry voices argue that reducing Kim Jung-dong to a mere acquaintance in allegations dismisses a decade-long legacy of pivotal contribution. The IPO phase was fraught with uncertainty, and securing investments to support soaring valuations was critical. Kim’s active involvement arguably facilitated this success rather than undermining it. The unfolding legal drama, therefore, reveals the complexities of navigating compliance in the rapidly evolving K-pop business ecosystem, where artistry, investment, and market regulation collide.